kansas dmv sales tax calculator

The following page will only calculate personal property taxes. Shawnee County is the third largest county in the state of Kansas and is the home of the capital city Topeka.

Car Tax By State Usa Manual Car Sales Tax Calculator

How kansas motor vehicle dealers should charge sales tax on vehicle sales.

. There are also local taxes up to 1 which will vary depending on region. Kansas Vehicle Property Tax Check - Estimates Only. Effective July 1 2002 if the vehicle is purchased in a taxing jurisdiction that has a lower.

Kansas Department of Revenues Division of Vehicles launched KnowTo Drive Online a web-based version of its drivers testing exam powered by Intellectual Technology Inc. The vehicle identification number VIN. The sales tax in Sedgwick County is 75 percent.

The information you may need to enter into the tax and tag calculators may include. Vehicle property tax is due annually. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

Average Local State Sales Tax. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. How to Calculate Kansas Sales Tax on a Car To calculate the sales tax on your vehicle find the total.

There are also local taxes up to. Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the.

Use the Kansas Department of Revenue Vehicle Property Tax Calculator to estimate vehicle property. If you are unsure. To calculate sales tax visit Kansas Department of Revenue Sales Tax Calculator.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. The sales tax in Sedgwick County is 75 percent. How to Calculate Kansas Sales Tax on a Car.

Vehicle tax or sales tax is based on the vehicles net purchase price. You pay property tax when you initially title and register a vehicle and each year when you renew your vehicle tags and registration. In addition to taxes car.

Multiply the vehicle price. The date that you. Maximum Local Sales Tax.

Maximum Possible Sales Tax. The following page will only calculate personal property taxes. How kansas motor vehicle dealers should charge sales tax on vehicle sales.

The minimum is 65. Learn more about Shawnee County in the Visitors CenterFind out about local. Vehicle Tax Costs.

Burghart is a graduate of the University of Kansas. Kansas State Sales Tax. There are also local taxes up to 1 which will vary depending on region.

The make model and year of your vehicle. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. A sales tax receipt is required if you have purchased the vehicle from a Kansas motor vehicle dealer.

Its fairly simple to calculate provided you know your regions sales tax. Motor vehicle trailer atv and watercraft tax calculator.

Treasury Unified Government Of Wyandotte County And Kansas City

Kansas Department Of Revenue Division Of Vehicles Home Page

License Plates And Permits Johnson County Kansas

Treasurer Douglas County Kansas

Motor Vehicle Titling Registration

Property Taxes Chanute Ks Official Website

What New Car Fees Should You Pay Edmunds

Sales Tax Bonner Springs Ks Official Website

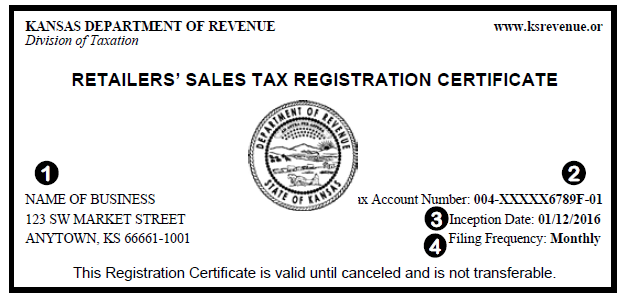

How To Register For A Sales Tax Permit In Kansas Taxjar

Sales Taxes In The United States Wikipedia

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Kansas Car Registration Everything You Need To Know

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Kansas Department Of Revenue Business Tax Home Page

Wilson County Kansas Motor Vehicle